AI-ling Sentiment Amid Macro Policy Uncertainty

- SWS

- Mar 28, 2025

- 9 min read

Energy Policy Perspectives Vol. 6 - March 28, 2025

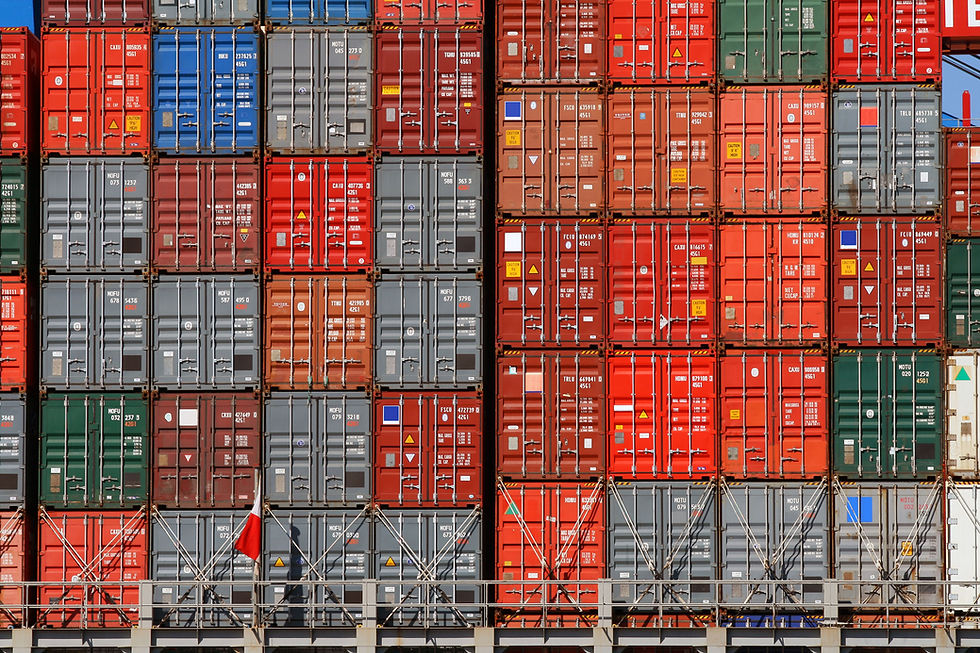

Uncertainty and noise accompany tariff policies. The uncertainty around the implementation of President Trump’s tariff strategy and potential retaliation, perhaps even more than the tariffs themselves, have clearly created turmoil throughout the stock market in recent weeks. While several other tariffs have been threatened, teased, announced, and delayed, only the additional 20% tariff on all Chinese goods and 25% tariff on all foreign steel and aluminum have taken effect thus far. The Trump Administration is planning to impose a fresh round of “reciprocal tariffs” on all U.S. trading partners on April 2nd, which it has called “Liberation Day”, the same day its one-month delay of its 25% tariffs on Canada and Mexico are set to expire. Additionally, the recently announced 25% auto import tariff and 25% tariff on all countries who purchase oil from Venezuela are expected to begin on or after April 2nd (potentially a 45% cumulative tariff on China). The market will likely continue to react to any comments made ahead of April 2nd but President Trump’s March 26th comments that his reciprocal tariff policy will be on “all countries” but would be “very lenient” suggest that the tariffs could be less onerous than originally suggested. This uncertainty alone has been sufficient to disrupt and influence equity investor sentiment while the stock market has attempted to sift the actual tariff policy implication “signal” from the “noise” presented by the White House nearly daily. We believe that both have significant ramifications for the energy sector as it complicates strategic planning.

Tariff effects have begun. Economics after all is largely about human nature and consumer expectations. People react to proposed policy/events and those reactions produce effects in the economy. In addition to the market turmoil, uncertain tariffs have already begun to affect the economy. While many market observers point to the April 2nd “Liberation Day” date to glean greater investment clarity, reports from various industries have indicated that costs have already begun to increase for various products across numerous industries in both the U.S. and its trading partners, particularly China, Canada, and Mexico. Also, while we may have greater clarity of the Trump administration tariffs next week, it will only kickstart another round of retaliation and the resulting implications of all global tariff actions for the domestic economy will remain uncertain for some time in our view.

Uncertainty creeps into market narratives. Some energy and AI stocks have been caught up in the ongoing market correction, but we believe that the structural AI- electricity demand story as part of the broader electrification theme remains intact and remains a strategic priority of the Trump Administration. We continue to believe that fossil fuels (primarily natural gas), nuclear power, and energy infrastructure in general are ultimately the big winners of much of the administration’s policy objectives. Tariffs have dominated the narrative lately and perhaps played a larger role than originally envisioned, but it is important to remember that this administration is also expected to bring deregulation and permitting reform that along with the significant corporate spending initiatives announced thus far that could have a positive impact in the future. However, in the near-term, some very real issues and policy inconsistencies will need to be resolved to further the stated energy policy objectives of the White House and ease markets.

Tariffs likely to exacerbate supply chain challenges. As we have noted in prior Policy Perspectives discussions, while tariffs could eventually help support greater production and demand for domestic goods, a cascading set of near-term issues are created when those goods are currently dependent upon foreign raw materials/inputs and/or domestic production capacity is insufficient to meet domestic demand. Electric transformers, which are required to connect basically anything to the grid are a critical example of the ongoing supply chain challenges that have pushed transformer delivery lead times to from several weeks back in 2018 to as long as a couple of years today. Mexico and China are two of the top three electric transformer exporters globally (Germany is #2) and the top two exporters to the United States. Even though efforts to improve domestic production are underway, these projects can’t be built overnight and due to a lack of experience, the maturity of supply chains and other factors could easily end up more expensive than pre or even post tariff imports. Meanwhile tariffs put immediate pressure on the supply chains of raw materials like steel, aluminum (conductor), wood (including distribution poles), as well as finished infrastructure equipment such as transformers, etc. After a February 25th executive order directed Commerce Secretary Howard Lutnick to investigate whether foreign production of copper posed a national security risk, there is growing market concern that a copper tariff could also be on its way. Copper prices have risen more than 15% this month to record levels. With copper a key component in EVs, wind turbines, housing, and in the power grid more broadly, the impact of copper tariffs could be significant for the economy and energy projects more specifically. Copper supply is already facing global shortages that the IEA projects could grow to 20% by 2030. Retaliatory tariffs (China, Canada, Mexico and the EU have all threatened retaliation) also are likely to have further disruptive economic effects.

Economic growth concerns rising. While the actual economic impacts of the tariffs are still unclear and the U.S. trading partner responses remain unknown, there have already been some clear indications of a slowing U.S. economy. In some of the more concerning data points this week, the Conference Board’s Consumer Confidence Index plummeted on Tuesday by 7.2 points to 92.9 while the Expectations Index declined 9.6 points to 65.2, the lowest level in 12 years. The Expectations Index below the 80 level has often signaled a looming recession. Over 67% of respondents are now expecting a recession over the next 12 months. Perhaps most troubling were 12-month inflation expectations that rose to 6.2% in March from 5.9% in February. Declining consumer confidence and rising inflation expectations could certainly mute consumer spending to some yet unknown degree as demonstrated by soft March retail sales figures. A recent CNBC CFO survey also expressed some concerns about inflation and tariffs.

Wealth effects. While tariff talk has led to a stock market correction (down 7.4% from the February 19th intra-day high record), the wealth effect from the loss of more than $4 trillion from the S&P 500 stocks alone is unknown. However, it is almost certain to be weighing on consumer sentiment and spending. While the S&P 500 has declined roughly 7.4% since February 19th and 3.2% year-to-date, energy stocks have fared better. The PHLX Utility Sector Index (UTY) has only declined 1.8% since February 19th and has actually risen 4.5% year-to-date. We expect the considerable economic uncertainty to remain for some time, leaving defensive sectors like utilities in favor for the time being. While inflation and interest rate concerns remain, economic growth concerns will likely trump them for investors. Also, we note that the secular utility infrastructure growth story has yet to be fully reflected in utility stocks despite the AI boom (with much concentrated in select IPP names thus far), in our view, leaving a longer-term tailwind for utility stocks yet unrealized.

Effects on energy infrastructure. While tariffs could disrupt the economy broadly, we are more concerned about energy sector costs and adequate supply chain availability. Higher costs could lead to utilities and electricity generators achieving less volume of infrastructure expansion and modernization than would otherwise be possible. As the IEA notes, there is already a massive backlog in global interconnections waiting just for new renewable generation that needs to be addressed (The 3000-GW Waiting List for a Modern Grid). What is critical at this time is achieving great volumes of grid and generation resource expansion, not merely achieving larger capital spending. As noted by NextEra’s (NEE, $70.03, Not Rated) CEO John Ketchum at CERAWeek earlier this month, there are already too many constraints in supply chains such as natural gas turbine availability to meet the electricity demand growth expected over the next decade that could be further exacerbated by even more supply chain constraints, reduced global trade and higher costs (Top US Utility Says Gas Can Meet Only a Fraction of Power Demand). Potentially higher inflation and interest rates could likewise prove a constraint on the new energy infrastructure build-out. Finally, with consumers expressing concerns about the economy and their current perceptions of the rising costs of living, and with some more elevated recession risk evident, we worry that state utility regulators could respond to evolving economic conditions with a more restrictive regulatory climate that is less supportive of the magnitudes of utility investment needed to support robust electricity demand growth expectations.

Sometimes conflicting policy messages and results. While President Trump has made AI and increasing electricity supply cornerstones of his earlier policy statements, some of the policies thus far appear to contradict or have unexpected consequences relative to those objectives. Potentially raising the costs of aluminum, copper, or transformers certainly will not accelerate energy infrastructure expansion to enable AI growth. In one key example, on March 10th in response to U.S. tariff threats for Canada, Ontario province Premier Doug Ford proposed a 25% electricity surcharge (tariff) on electricity exports to Minnesota, Michigan, and New York after initially saying it would cut off electricity exports to the U.S. entirely. The surcharge was subsequently postponed pending trade negotiations, and the key New England electricity exports were never seemingly considered. However, the potential loss of clean and relatively low-cost electricity resources is certainly an unintended consequence of tariffs and contrary to the broader policy objectives. The conflicting and unforeseen ramifications of the proposed tariffs on energy infrastructure costs and supply chains may simply make it make more difficult for energy infrastructure companies to plan and pay for new investments and achieve the significant volume growth and modernization of U.S. energy infrastructure required over the next few decades.

IRA Reductions? On March 9th, 21 House Republicans publicly opposed the administration proposal for eliminating IRA tax credits. The House Republicans delivered a letter to the chairman of the House Ways & Means Committee to express their support for certain IRA tax credit provisions that have helped foster investment and job creation in their respective districts. This Republican response was an improvement from last August when 18 (14 who remain in Congress) sent a similar letter of support for the IRA to the Speaker of the House. Some groups have estimated that as much as 85% of IRA benefits have been reaped in Republican districts. The potential repeal of portions of the IRA, the impacts of cuts to some key federal agencies, the impact of a slowdown of federally funded STEM research, and other actions all could threaten to have material impacts on energy sector investment across various timescales. The withdrawal of the air permit of an offshore wind project could also have a chilling effect on some electricity project investment planning (EPA yanks air quality permit for 1.5- GW Atlantic Shores offshore wind project). Without greater IRA and renewable energy policy clarity, energy infrastructure investment is certain to slow somewhat if not repeat historic cycles of reduced development.

NO(AA) more. The EPA, which previously announced 31 actions as it seeks to repeal several environmental regulations, is not the only U.S. agency undergoing changes. NOAA has seen its workforce cut by roughly 10%, with its former deputy director Andrew Rosenberg saying that the agency plans to lay off around 50% of its staff with reports suggesting DOGE intends to cut the agency’s budget by 30%. There is a concern that many of NOAA’s services and weather forecasts are aimed to be privatized and that weather/climate forecasting could suffer and adversely affect issues such as storm or wildfire response and preparation, critical services for protecting energy infrastructure.

Good energy policy news. While tariffs have created uncertainty, there has been some more constructive policy and energy market developments in recent weeks. New nuclear energy support continues to grow and despite some administration rhetoric opposed to renewable energy, there have also been some clarifying statements that suggest the administration may be more pragmatic about renewable electricity generation resources and EVs.

New nuclear support continues to grow. Big tech companies have shown a desire for not only reliable but clean energy. In addition to the news about their PPA support for the restoration of some shuttered nuclear units, the recent pledges from Big Tech have provided further support for new nuclear energy (Amazon, Google sign pledge to support tripling of nuclear energy capacity by 2050). Increasing support for new nuclear power generation development is critical, in our view, as technology is best positioned to provide reliable, baseload power given some of the limitations of hydropower and geothermal generation which both represent alternative renewable, clean and dispatchable energy generation sources. While nuclear is technically dispatchable, like all large thermal plants it is hard/slow to start and stop and its economics are best when operated at a high capacity factor. This is not an issue and in fact a competitive advantage when meeting AI data center demand, which also has economics dependent upon near 24/7 up-times, but underscores the importance of a diversified energy mix to cost effectively meet more broad electricity demand growth which will have daily and seasonal fluctuations.

Further critical minerals policy support. On March 20th, President Trump issued the Immediate Measures to Increase American Mineral Production executive order. The latest order extends the intent of the January 20th energy-related executive orders, instructing the development of new leases for the exploitation of domestic resources. While the policy will not help supply chains in the short-run, it could be a positive development over the next few decades when resource availability may become an even more acute constraint on energy infrastructure investment.

Positive remarks on solar, storage and EVs from Energy Secretary. At CERAWeek on March 11th, Department of Energy Secretary Chris Wright doubled down on the Trump administration’s focus on fossil fuels but also said that solar, storage, and electric vehicles have their place in the Trump Administration’s energy policy approach (DOE will prioritize fossil fuels, but it still expects strong growth from storage, solar, Wright says). We find this clarification of administration policy notable as solar, as well as wind, was not originally included in the definition of energy resources used in President Trump’s initial January 20th executive orders and the President has repeatedly voiced disdain for electric vehicles and wind power. Wright encouraged businesses to “build EVs, innovate EVs, sell them. Consumers will buy them. We’re for all of that. We’re just not for reducing choice and taking American taxpayer money to subsidize wealthy people.” However, Secretary Wright continued to criticize wind, on which Trump previously issued an executive order to pause the development of on federal lands/waters.

PLEASE SEE BELOW FOR IMPORTANT DISCLOSURES, REG AC ANALYST CERTIFICATION AND DISCLAIMERS

Siebert Williams Shank & Co., LLC or its Affiliates do and seek too business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.

Analyst Certification

We, Christopher R. Ellinghaus and Gabriele Sorbara hereby certify that the views expressed in this research report accurately reflect our personal views about the subject companies and their securities. We further certify that no part of our compensation was, is, or will be directly, or indirectly, related to the specific recommendations or views contained in this research report.

Financial Interests: Neither we, Christopher R. Ellinghaus or Gabriele Sorbara, nor any member of our households own securities in any of the subject companies mentioned in this research report. Neither we, nor a member of our households is an officer, director, or advisory board member of the subject company or has another significant affiliation with the subject company. We do not know or have reason to know at the time of this publication of any other material conflict of interest.

Analyst Compensation: The authors compensation is based upon the value attributed to research services by Siebert Williams Shank institutional brokerage clients. The authors of this report are compensated based on the performance of the firm, and have not received any compensation in the past 12 months from any of the subject companies mentioned in this report. The performance of the firm is driven by its secondary trading revenues, investment banking revenues, and asset management revenues.

Siebert Williams Shank Equity Research Ratings Key

BUY: In the analyst's opinion, the stock will outperform the S&P 500 on a total return basis over the next 12 months.

HOLD: In the analyst's opinion, the stock will perform in line with the S&P 500 on a total return basis over the next 12 months.

SELL: In the analyst's opinion, the stock will underperform the S&P 500 on a total return basis over the next 12 months.

Distribution of Equity Research Ratings as of: March 27, 2025

IBC (Investment Banking Clients) is defined as companies in respect of which Siebert Williams Shank (the “firm”) or its affiliates have received or are entitled to receive compensation for investment banking services in connection with transactions that were publicly announced in the past 12 months.

Other Important Disclosures

Investment Banking Disclosures: Within the past 12 months, the research analyst authoring this report has not participated in a solicitation of any subject company mentioned within this report, with or at the request of investment bankers, for investment banking business. Within the past 12 months, the firm and its affiliates have not managed or co-managed a public offering of the securities of any subject company mentioned within this report, nor has the firm received compensation for investment banking products or services from those companies.

Firm Compensation: Within the past 12 months, the firm and its affiliates have not received compensation for any non-investment banking products or services for subject companies mentioned in this report, and none of these subject companies have been a client of the firm during the past 12 months.

Stock Ownership: The firm and its affiliates do not own 1% or more of any class of equity security in this report, and do not make a market in any such securities.

Disclaimers: The information and opinions contained in this report were prepared by the firm and have been derived from sources believed to be reliable, but no representation or warranty, expressed or implied, can be made as to their accuracy. All opinions expressed herein are subject to change without notice. This report is for information purposes only and should not be construed as an offer to buy or sell any securities. The firm makes every effort to use valuation methodologies that it believes to be reasonable in the derivation of price targets, but we do not guarantee that such methodologies are accurate.

Additional Information: To receive any additional information upon which this report is based, please contact:

Siebert Williams Shank, Research Department

100 Wall Street, 18th Floor New York, NY 10015

212-830-4500